Out-of-network medical billing can be a highly complex and nuanced area for healthcare providers. Unlike in-network billing, which involves pre-negotiated rates with insurance companies, out-of-network billing often means navigating unpredictable reimbursement rates, higher patient financial responsibility, and the possibility of payment delays or denials. This guide aims to clarify the key concepts in out-of-network billing, outline best practices for maximizing reimbursement, and provide tips on handling common obstacles in this billing domain.

Understanding Out-of-Network Medical Billing

Out-of-network billing occurs when a provider delivers services to a patient whose insurance does not have a direct agreement with the provider. This typically means:

- Higher Reimbursement Rates: Out-of-network providers often set their own charges, which may be higher than in-network rates. However, reimbursement is not guaranteed, as insurers often pay only a percentage of the usual and customary rates.

- Increased Patient Responsibility: Patients with out-of-network benefits may still face higher deductibles, coinsurance, and out-of-pocket expenses.

- Balance Billing: Many out-of-network providers practice balance billing, where the patient is billed for the remaining balance after insurance pays its portion. However, some states have restrictions on balance billing, especially for emergency services.

Handling Common Obstacles in Out-of-Network Billing

Out-of-network billing comes with its own set of challenges. Below are common obstacles and recommended approaches to tackle them:

- Denials and Underpayments: Insurers frequently deny or underpay out-of-network claims. Having a dedicated team that can appeal denials, review claims for compliance, and correct any errors can significantly improve payment rates.

- Insurance Company Negotiations: Some insurers offer limited reimbursements for out-of-network services. Proactive negotiation with payers, including justifying medical necessity and usual charges, is critical for achieving fair reimbursements.

- Patient Financial Counseling: Since out-of-network services often involve higher patient costs, offering financial counseling can reduce the likelihood of bad debt. Educating patients on available payment plans or financial assistance options can also improve patient satisfaction.

Managing Patient Expectations and Communication

Patient communication is essential in out-of-network billing, as unexpected bills can lead to frustration and disputes. Here’s how to improve patient interactions:

- Transparency: Clearly outline the expected charges, anticipated insurance payment, and remaining balance to the patient.

- Flexible Payment Plans: Offer payment options that can alleviate the financial burden on patients, making it easier for them to pay their portion.

- Regular Follow-Ups: Post-service follow-ups can help address any concerns and support patients in managing their bills, ultimately reducing delays in payments.

The Role of a Specialized Billing Partner

Navigating the complexities of out-of-network billing can be overwhelming for practices. Partnering with a specialized billing provider can ease this burden, as such experts understand payer dynamics, regulatory requirements, and the nuances of out-of-network claims management. A well-versed billing partner can help providers optimize their out-of-network revenue while freeing up valuable resources for patient care.

In-Network vs. Out-of-Network Providers: Key Differences

Understanding the distinctions between in-network and out-of-network providers is crucial for both patients and healthcare providers, as these differences significantly impact reimbursement rates, patient costs, and the billing process. Here’s a closer look at these two types of provider arrangements:

Definition and Basic Differences

- In-Network Providers: These providers have contractual agreements with insurance companies, agreeing to offer services at pre-negotiated rates. In exchange, insurance companies direct patients to these providers by covering a higher percentage of the service costs, often resulting in lower out-of-pocket expenses for patients.

- Out-of-Network Providers: Out-of-network providers, on the other hand, have no contract with the patient’s insurance company. They are not bound by in-network rate agreements, allowing them to set their own charges. Since these providers are not in the insurance company’s network, patients may have higher deductibles, copays, and out-of-pocket expenses when receiving care from them.

Key Differences in Billing and Reimbursement

Rate Negotiation and Reimbursement:

- In-Network: Rates are negotiated with the insurance company and are usually lower than out-of-network rates. Insurers reimburse a fixed portion based on these contracted rates, and providers typically accept the insurance payment as full payment, apart from patient copays and deductibles.

- Out-of-Network: Providers are free to set their own rates for services. Insurance companies may reimburse only a percentage of the usual and customary charges, often leaving patients responsible for the remaining balance. This arrangement frequently leads to balance billing, where the patient pays the difference between what the insurance reimburses and the provider’s rate.

Patient Costs:

- In-Network: Patients generally have lower out-of-pocket costs for in-network services due to lower copays, deductibles, and coinsurance percentages. Many insurance plans offer extensive coverage when patients see in-network providers, minimizing their financial burden.

- Out-of-Network: Out-of-pocket costs tend to be higher when patients visit out-of-network providers, as insurance may only cover a fraction of the bill, if at all. Out-of-network benefits often come with higher deductibles and coinsurance rates, and patients are typically responsible for any unpaid balance after insurance coverage.

Billing Processes and Claim Submissions:

- In-Network: Billing is streamlined for in-network providers, as they submit claims directly to the insurance company. Reimbursement rates and processes are pre-established, often leading to faster payment cycles and fewer disputes.

- Out-of-Network: Out-of-network providers may require patients to submit claims directly to their insurance companies. While some out-of-network providers may assist with claims by providing super bills, the responsibility often lies with patients to file for reimbursements, leading to a lengthier and more complex claims process.

Authorization and Coverage Verification:

- In-Network: In-network providers frequently handle prior authorization and insurance verification processes on behalf of the patient, reducing administrative tasks for the patient. These providers are typically more aware of the insurer’s coverage criteria and documentation requirements.

- Out-of-Network: Out-of-network providers may not initiate insurance verification or prior authorization. In these cases, patients are often responsible for confirming their own coverage and eligibility, adding complexity to the healthcare experience.

Provider Freedom and Flexibility:

- In-Network: Since they are under contract with insurance companies, in-network providers may be limited in terms of pricing and service flexibility. They are bound by the insurer’s terms, which can sometimes limit the scope of services or procedures that are fully reimbursed.

- Out-of-Network: Out-of-network providers have greater freedom to structure their services and pricing as they see fit, allowing for potentially more individualized or specialized care. They are not restricted by the terms of an insurance contract, giving them autonomy over treatment decisions and charges.

Patient Choice and Accessibility:

- In-Network: Patients with insurance often prefer in-network providers to minimize their costs, which can limit the patient’s choice if certain specialists or facilities are not in-network.

- Out-of-Network: Patients may opt to see out-of-network providers to access specific specialists, advanced treatments, or shorter wait times, despite higher costs. Out-of-network providers offer greater choice but often at a higher expense, especially when dealing with unique or niche treatments.

Summary: Choosing Between In-Network and Out-of-Network Providers

While in-network providers are typically more affordable and convenient due to their agreements with insurers, out-of-network providers offer greater flexibility and autonomy, which can be valuable for patients seeking specific expertise or services. However, out-of-network care usually comes with higher costs and a more complex claims process, making it essential for patients to weigh the benefits and drawbacks of each option based on their healthcare needs, budget, and insurance coverage.

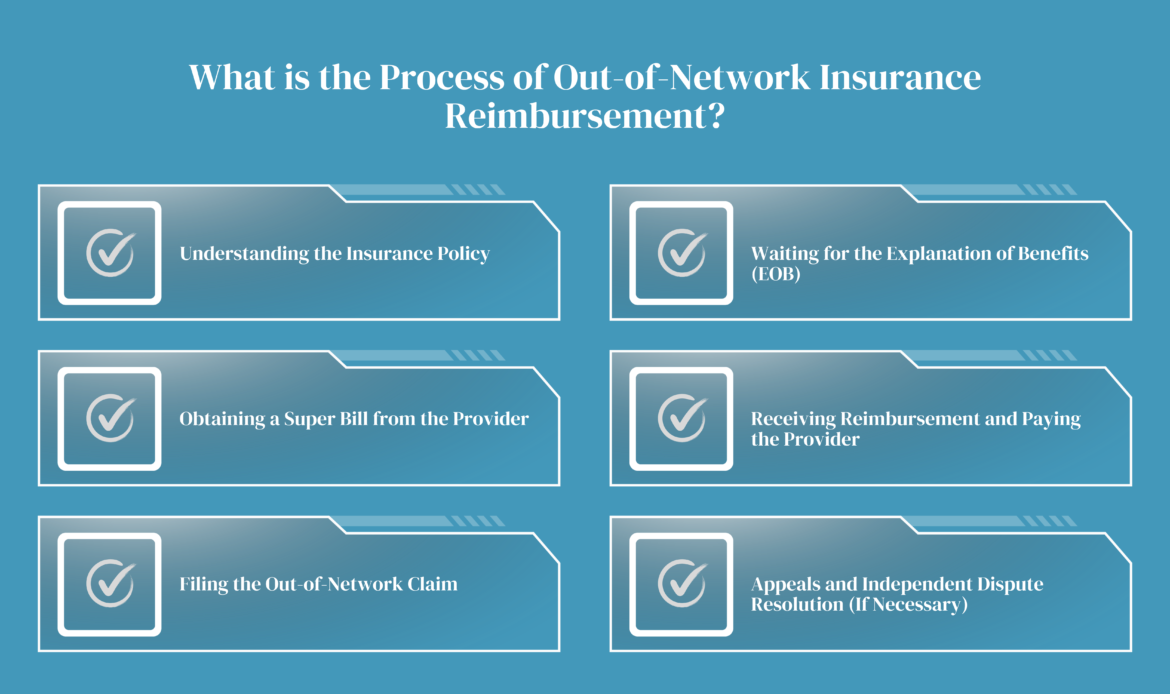

What is the Process of Out-of-Network Insurance Reimbursement?

The process of obtaining insurance reimbursement for out-of-network medical services can be complex, as it typically requires additional steps compared to in-network billing. However, understanding each step can help patients navigate the reimbursement process more effectively, ensuring that they maximize their eligible benefits. Here’s a breakdown of the steps involved in securing out-of-network insurance reimbursement:

Step 1: Understanding the Insurance Policy

Before seeking reimbursement, patients need to understand the out-of-network coverage in their insurance policy. Out-of-network benefits often come with higher deductibles, coinsurance, and out-of-pocket maximums than in-network care, which directly impacts the amount reimbursed. Patients should confirm with their insurer:

- The reimbursement percentage for out-of-network services.

- Any caps on reimbursement or maximum limits.

- Whether prior authorization is required for certain services.

Step 2: Obtaining a Super Bill from the Provider

After receiving care from an out-of-network provider, patients should request a “super bill.” This document is an itemized receipt that includes all relevant service details, such as:

- The provider’s name, contact, and National Provider Identifier (NPI) number.

- A breakdown of services performed with corresponding CPT (Current Procedural Terminology) codes.

- ICD (International Classification of Diseases) codes for diagnoses.

- The total cost charged for each service or procedure.

The super bill provides the necessary information for the insurance company to process a claim, as it includes both procedural and diagnostic details.

Step 3: Filing the Out-of-Network Claim

Patients typically must submit their out-of-network claims manually, as out-of-network providers do not have direct billing agreements with insurers. The process involves:

- Filling out an out-of-network claim form from the insurance company, available through their website or customer service.

- Attaching the super bill along with any other required documentation.

- Providing proof of payment if the patient has already paid the provider directly.

It’s essential to double-check that all information is accurate and complete, as mistakes can lead to delays or claim denials. Patients can submit the form online or by mail, depending on their insurer’s guidelines.

Step 4: Waiting for the Explanation of Benefits (EOB)

Once the claim is submitted, the insurance company reviews it and issues an Explanation of Benefits (EOB). The EOB outlines:

- The services covered by insurance.

- The allowed amount (the insurer’s maximum payment for each service).

- The amount reimbursed and what the patient owes.

- The amount applied toward the patient’s deductible and out-of-pocket maximum.

The EOB is essential because it details why certain charges may have been denied or only partially covered, offering transparency into the reimbursement decision.

Step 5: Receiving Reimbursement and Paying the Provider

If the patient hasn’t yet paid the provider, they can use the insurance reimbursement to settle the bill. In cases where the provider required pre-payment, the reimbursement goes directly to the patient to offset out-of-pocket expenses.

The amount reimbursed by the insurer depends on several factors:

- The difference between the provider’s charges and the allowed amount.

- The patient’s coinsurance percentage and deductible.

- Any applicable caps or limits on out-of-network benefits.

Step 6: Appeals and Independent Dispute Resolution (If Necessary)

If the insurance company denies or underpays the claim, patients may have the option to appeal the decision. This involves submitting additional documentation or providing a rationale as to why the service should be covered under out-of-network benefits. Additionally, under the No Surprises Act, patients may have access to an independent dispute resolution (IDR) process for certain cases where insurance companies and providers disagree on reimbursement.

Important Tips for a Smooth Reimbursement Process

- Keep Copies of All Documentation: Always retain copies of the super bill, claim forms, EOB, and any correspondence with the insurance company.

- Stay Aware of Submission Deadlines: Many insurers have deadlines for filing claims, often within 90 days of the service date. Late claims may be denied, so it’s crucial to submit promptly.

- Follow Up with the Insurance Company: Reimbursement can take time, especially if additional documentation or clarification is needed. Patients should follow up to track the claim status.

- Work with the Provider for Required Documentation: Some insurers request additional details, such as provider notes or medical necessity justifications. Patients should communicate with their providers to ensure all required information is available.

Summary: Maximizing Out-of-Network Reimbursements

While securing reimbursement for out-of-network services can be challenging, understanding the process helps patients make the most of their benefits. By carefully following each step, maintaining organized documentation, and communicating with both their provider and insurer, patients can effectively navigate the reimbursement process and reduce their out-of-pocket expenses for out-of-network care.

The Role of Super Bills in Out-of-Network Billing

Super bills play a critical role in the out-of-network billing process, serving as a valuable tool for both healthcare providers and patients. A super bill is an itemized receipt provided by healthcare providers to patients, detailing the services rendered, the costs involved, and all necessary codes required for insurance claims submission. Super bills enable patients to claim reimbursement from their insurance for services provided by out-of-network providers, facilitating the often complex reimbursement process.

What Is a Super Bill?

A super bill is an itemized document that includes essential information for insurance purposes, such as:

- Patient and Provider Details: Names, addresses, and contact information of both the patient and the provider.

- Date of Service: The exact dates when services were provided.

- Procedure and Diagnosis Codes: CPT (Current Procedural Terminology) codes for procedures and ICD (International Classification of Diseases) codes for diagnoses.

- Charges: The provider’s fee for each service or procedure.

- Provider’s National Provider Identifier (NPI): Unique identifier for the healthcare provider.

- Tax ID and License Number: Provider’s federal tax identification number and state license number.

These details ensure that insurance companies have the information they need to process reimbursement claims accurately and quickly.

How Super Bills Benefit Out-of-Network Billing

Streamlines Reimbursement for Patients: Since out-of-network providers do not bill insurance companies directly, super bills provide patients with the documentation they need to submit their own claims to their insurance company for reimbursement. This documentation allows the insurance provider to assess the claim based on the services rendered and determine the patient’s reimbursement.

Reduces Administrative Burden for Providers: Out-of-network providers are not obligated to deal with the insurance claim submission and negotiation processes. Instead, by issuing super bills, they can streamline their administrative tasks while empowering patients to pursue their reimbursements independently.

Increases Patient Satisfaction and Financial Transparency: Offering a super bill enables patients to better understand the cost breakdown of their healthcare services, fostering transparency. Patients who are knowledgeable about their charges and eligible reimbursements tend to feel more in control of their finances, which can enhance satisfaction and trust in their provider.

Improves Accuracy and Compliance: Super bills must include accurate CPT and ICD codes, ensuring that the services are appropriately documented and compliant with current coding standards. This accuracy helps mitigate the risk of insurance denials due to incorrect coding, ultimately facilitating a smoother reimbursement process for the patient.

Facilitates Negotiation of Reimbursement Rates: Patients may use super bills to request reimbursement based on the usual and customary rates established by their insurance providers. Although insurers may offer partial payments for out-of-network claims, patients can use these super bills as documentation to negotiate higher reimbursements.

Best Practices for Using Super Bills in Out-of-Network Billing

- Ensure Accurate and Detailed Coding: Coding accuracy is vital, as errors can lead to claim denials or reduced reimbursement amounts. Providers should work with skilled billers or a coding service to ensure correct and up-to-date CPT and ICD codes on super bills.

- Educate Patients on Submission Procedures: Providers should inform patients on how to submit super bills to their insurance companies, including any specific documentation requirements or timelines. Providing a step-by-step guide can increase the likelihood of patients receiving timely reimbursements.

- Offer Support for Insurance Reimbursement Inquiries: Although providers may not manage the insurance submission, offering assistance or guidance in filling out super bills, when needed, can further support patients, ensuring their claims process goes smoothly.

- Include Clear Cost Breakdown and Provider Information: A complete and transparent super bill with a detailed cost breakdown and provider information prevents delays and misunderstandings during the insurance review process, which may otherwise lead to stalled reimbursements.

Summary: Maximizing the Value of Super Bills

Super bills serve as a powerful tool in out-of-network billing by enabling patients to seek reimbursements independently, reducing administrative demands on providers, and promoting financial transparency. For healthcare providers, issuing super bills is a straightforward way to empower patients and improve their experience while maintaining an efficient revenue flow. By prioritizing accurate coding, detailed documentation, and patient education, providers can ensure that super bills effectively support both their practice and their patients in navigating the out-of-network billing landscape.

Out-of-Network Billing Laws: Understanding the Legal Landscape

Out-of-network billing laws have evolved in recent years to address the financial burdens that surprise medical bills can place on patients when they receive care from out-of-network providers. These laws are designed to protect patients from unexpected and excessive healthcare expenses by regulating out-of-network billing practices, especially in emergency or non-consensual situations where a patient may have limited control over provider choice. Below is a comprehensive look at these laws, how they affect providers and patients, and key regulations currently in place.

The Problem of Surprise Billing

Surprise billing, also known as balance billing, occurs when patients unknowingly receive care from out-of-network providers and are then billed for the balance after their insurance has paid its share. For example, this can happen when a patient is treated at an in-network hospital but receives services from an out-of-network anesthesiologist, radiologist, or other specialist without realizing it. Out-of-network billing laws seek to address these scenarios by shifting responsibility for the balance to insurers or limiting the amounts that out-of-network providers can charge.

Key Out-of-Network Billing Laws

No Surprises Act:

- Enacted in 2022, the federal No Surprises Act provides protections against surprise billing for most emergency services and certain non-emergency services provided by out-of-network providers at in-network facilities. Under this law, patients are only required to pay their in-network cost-sharing amounts for these services.

- The law also sets limits on what out-of-network providers can charge in these situations. Providers are prohibited from balance billing patients in situations covered by the No Surprises Act and are required to negotiate payment with the insurance company, resorting to independent dispute resolution if necessary.

- This act requires providers to give good faith estimates of healthcare costs for uninsured or self-pay patients and mandates a notice-and-consent process for certain out-of-network services when patients voluntarily choose out-of-network care.

State-Level Protections:

- Many states have enacted their own out-of-network billing laws, which may provide additional protections beyond those of the No Surprises Act. These laws vary widely, with some states offering comprehensive protections for both emergency and non-emergency situations and others focusing primarily on emergency services.

- Some state laws prohibit balance billing altogether for specific situations, while others limit the amount that out-of-network providers can bill patients. States like New York, California, and Texas have particularly robust out-of-network billing protections.

Balance Billing Limitations:

- In situations where patients have no control over the provider selection—such as emergency transport or care received from hospital-based providers—out-of-network billing laws often prevent balance billing. In-network cost-sharing rules apply, and out-of-network providers must accept a fair reimbursement rate, determined either through negotiation with the insurer or a dispute resolution process.

Independent Dispute Resolution (IDR):

- In cases where insurers and out-of-network providers cannot agree on reimbursement amounts, many laws—including the No Surprises Act—provide for independent dispute resolution processes. This arbitration-based approach allows a neutral third party to determine a fair payment amount. The IDR process aims to reduce conflicts over out-of-network charges, particularly in cases where patients cannot choose their providers.

Patient Disclosure Requirements:

- Out-of-network providers are required in many cases to inform patients of their out-of-network status before providing non-emergency services. Patients should receive a notice detailing potential costs and have the option to agree to the charges or seek alternative care.

- Providers must also supply good faith estimates, especially when treating self-pay patients or patients receiving out-of-network services. This transparency allows patients to better understand potential costs and make informed decisions about their care.

Emerging Trends in Out-of-Network Billing Laws:

- Recent legislation emphasizes more transparency and protection in healthcare billing, with a focus on preventive measures to address surprise billing. Some newer laws include provisions that require online cost estimators or prior authorizations for out-of-network services, allowing patients greater access to information upfront.

- Laws are also evolving to provide additional protections in telehealth services, given the growth of telemedicine and its billing challenges, especially in out-of-network cases where providers may be based in different states.

Impact on Providers and Patients

- For Providers: Out-of-network billing laws create new billing requirements and compliance standards. Providers must ensure accurate coding and transparent billing practices, especially when balance billing is restricted or prohibited. For out-of-network providers, adapting to these regulations means understanding specific state laws, maintaining compliance with federal laws like the No Surprises Act, and potentially using the IDR process to resolve billing disputes.

- For Patients: These laws offer significant financial protections, ensuring that patients are not caught off guard by unanticipated medical bills, especially in emergency or unavoidable out-of-network situations. Patients benefit from greater transparency, knowing upfront their financial responsibilities and understanding their rights against excessive charges.

Best Practices for Compliance with Out-of-Network Billing Laws

- Provide Clear and Comprehensive Notices: Ensure patients receive notices about any out-of-network services, including good faith estimates for self-pay patients and disclosures about potential costs.

- Stay Updated on State and Federal Laws: With evolving regulations, it is essential for providers to stay informed about both federal and state-specific out-of-network billing laws to avoid penalties and ensure full compliance.

- Utilize the IDR Process When Necessary: For disputes with insurers over reimbursement rates, providers can use the IDR process as outlined by the No Surprises Act, which can help resolve payment disagreements without passing costs to patients.

- Train Staff on Billing Procedures and Compliance: Front-end and billing staff should be well-versed in out-of-network billing laws, so they can provide accurate estimates, obtain informed consent when required, and handle disputes efficiently.

Navigating Out-of-Network Billing Compliance

Out-of-network billing laws have reshaped the billing landscape for providers and have greatly increased financial protections for patients. As these laws continue to evolve, understanding their impact is essential for providers to remain compliant and maintain trust with patients. By adhering to these laws, out-of-network providers can balance fair reimbursement practices with patient protection, enhancing the transparency and fairness of the healthcare billing process.

Key Terms in the Out-of-Network Medical Billing Process

Navigating the complexities of out-of-network medical billing requires familiarity with several essential terms. Understanding these key terms helps both providers and patients comprehend the billing process, anticipate potential costs, and ensure accurate reimbursements. Below are some of the most commonly used terms in out-of-network billing:

Balance Billing:

Balance billing occurs when an out-of-network provider bills the patient for the difference between their rate and the amount covered by the patient’s insurance. Many state laws and the federal No Surprises Act restrict or prohibit balance billing in certain cases, especially for emergency services.

Usual, Customary, and Reasonable (UCR) Rates:

UCR rates are the standard fees that insurance companies set as reasonable for a specific service within a geographical area. Out-of-network providers may charge higher rates than UCR, resulting in patients covering the difference, depending on their insurance coverage.

Allowed Amount:

The allowed amount, also known as the “eligible expense” or “negotiated rate,” is the maximum fee that an insurance company will pay for a covered service. For out-of-network services, the allowed amount is usually lower than the provider’s charge, leading to a larger patient responsibility.

Deductible:

A deductible is the amount a patient must pay out of pocket before their insurance starts covering costs. Out-of-network services typically come with higher deductibles, meaning patients pay more before receiving any reimbursement from their insurance.

Coinsurance:

Coinsurance is the percentage of a service cost that a patient is responsible for after meeting their deductible. For out-of-network services, coinsurance rates are often higher than for in-network care, meaning patients pay a larger share of the bill.

Copayment (Copay):

A copay is a fixed fee a patient pays for a medical service, usually applicable to in-network visits. Out-of-network services often don’t have a set copay, and instead, the patient may be responsible for a percentage of the cost (coinsurance) or the balance after insurance pays.

Explanation of Benefits (EOB):

The EOB is a document from the insurance company detailing what portion of a claim was covered, what was not covered, and any patient responsibility. The EOB helps patients understand their out-of-pocket costs for out-of-network services and verify that billing is accurate.

Super Bill:

A super bill is a detailed receipt provided by out-of-network providers that patients can submit to their insurance for reimbursement. It includes essential billing information, such as procedure codes, diagnoses, provider details, and the amount charged, allowing insurance to process claims for out-of-network services.

Out-of-Pocket Maximum:

The out-of-pocket maximum is the cap on total expenses a patient must pay in a year. For out-of-network care, expenses may apply differently, and reaching this limit may still leave patients responsible for balance bills, especially if the provider’s charges exceed UCR rates.

Independent Dispute Resolution (IDR):

IDR is a process outlined in the No Surprises Act that helps resolve billing disputes between insurers and out-of-network providers. This process allows a neutral third party to determine a fair payment amount, especially in situations where balance billing is restricted by law.

Prior Authorization:

Prior authorization is the insurance approval needed for certain services before they’re rendered, ensuring they’re covered under the patient’s plan. Out-of-network services often require more complex or additional prior authorization steps to verify coverage eligibility.

Non-Emergency vs. Emergency Services:

Out-of-network billing laws often distinguish between emergency and non-emergency services. In emergency situations, patients are protected from balance billing and can be charged only up to their in-network rate. For non-emergency services, different rules apply, and patients may face higher out-of-pocket costs when treated by out-of-network providers.

Assignment of Benefits (AOB):

An AOB is an agreement that allows an insurance company to pay benefits directly to the provider rather than to the patient. For out-of-network providers, some insurance plans do not allow AOBs, meaning patients may receive the reimbursement and then pay the provider themselves.

Provider Network:

The provider network is a list of healthcare professionals and facilities that have contracted with an insurance company to provide services at discounted rates. Providers outside this network are considered out-of-network, usually leading to higher costs for patients.

Good Faith Estimate:

A good faith estimate, required by the No Surprises Act, is a preliminary cost estimate provided to self-pay or uninsured patients for out-of-network services. This estimate helps patients make informed decisions by understanding potential out-of-pocket expenses upfront.

Conclusion:

Out-of-network medical billing can be a complex and often overwhelming process for both healthcare providers and patients. Understanding the various components, from billing practices and insurance reimbursements to legal protections and key terms, is essential for navigating the challenges associated with out-of-network services. By staying informed about the distinctions between in-network and out-of-network care, utilizing tools like super bills, and being aware of important billing laws, patients can better manage their healthcare costs and minimize unexpected expenses.

Moreover, understanding the reimbursement process, knowing when and how to appeal claims, and working with insurance providers and medical professionals can significantly reduce financial stress. With the right knowledge and strategies in place, patients and providers alike can ensure that out-of-network billing is handled efficiently and transparently. Whether you are a patient seeking reimbursement or a provider managing out-of-network claims, being proactive and well-informed can make all the difference in optimizing financial outcomes and ensuring that medical care remains accessible and affordable.