Small healthcare practices often face the challenge of managing their Accounts Receivable (AR). Effective AR management goes beyond just collecting payments it’s about creating sustainable financial health, improving patient relationships, and ensuring long-term operational efficiency. At MediBill Health Partners, we understand that optimizing AR recovery is key to the success of any practice. Below, we’ll explore practical, in-depth strategies designed specifically for small healthcare practices looking to recover AR more efficiently.

What is Accounts Receivable (AR) in Healthcare?

Accounts Receivable (AR) refers to the outstanding payments owed to healthcare providers by patients or insurance companies. These receivables stem from bills generated for services rendered and insurance claims awaiting settlement. For small practices, efficiently managing these receivables ensures smooth cash flow, reduces financial strain, and supports sustainable growth.

The Accounts Receivable Process in Healthcare

Understanding the AR cycle is crucial to improving recovery rates. Here’s a breakdown of how AR works in most healthcare settings:

- Billing Initiation

After a patient receives care, a bill is generated, or a claim is submitted to their insurance provider. This marks the beginning of the AR process.

- Waiting for Payment

The receivable remains outstanding until the patient or insurance company completes payment. During this period, it’s essential to follow up consistently to ensure the bill doesn’t age unnecessarily.

- Payment Completion

Once the payment is received, the AR account is closed. However, if left unattended, AR balances can turn into bad debts, which are harder to recover.

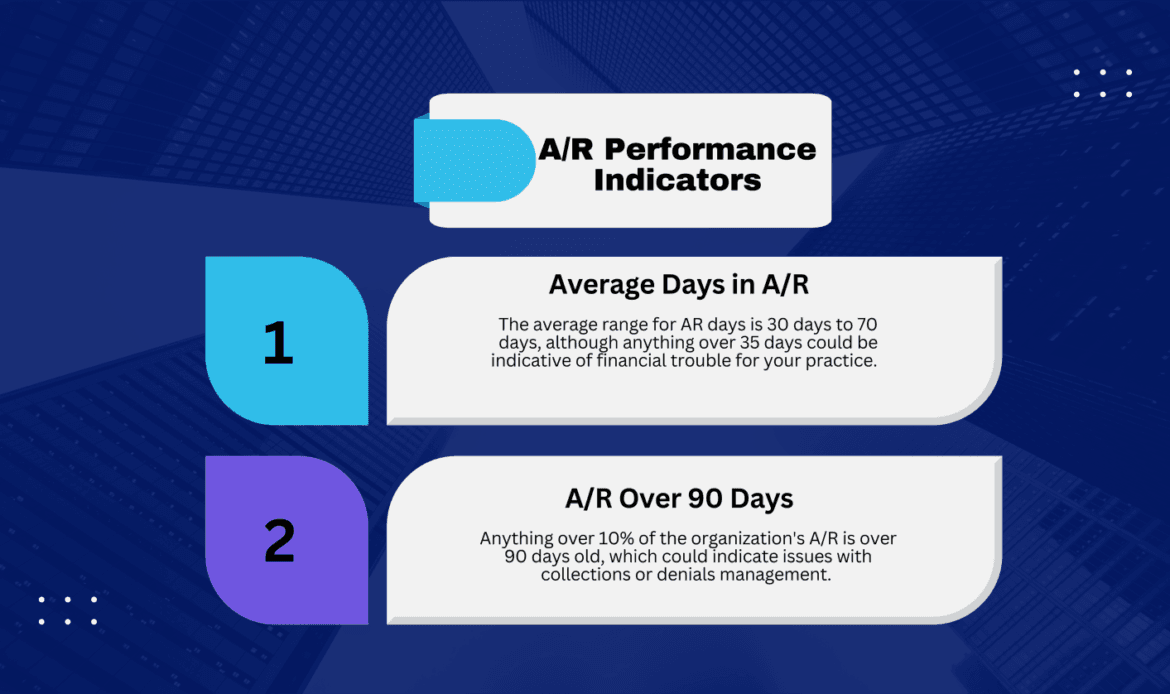

Key Performance Indicators

Why AR Recovery is Critical for Small Practices?

For small healthcare practices, AR recovery directly impacts financial health. Without timely collection of receivables, practices may struggle to cover operating expenses, pay staff, or invest in new equipment. Beyond financial stability, efficient AR recovery also affects patient trust and overall operational efficiency.

- Financial Stability and Cash Flow

An excessive AR backlog drains a practice’s resources. Outstanding payments lock away funds that could be used for other essential operations, limiting the practice’s ability to grow.

- Risk of Non-payment

The longer an account remains unpaid, the more likely it is to become a ‘bad debt.’ Small practices, in particular, cannot afford to let invoices go unpaid for extended periods, as this can lead to significant financial losses.

- Operational Efficiency

Efficient AR management not only improves cash flow but also frees up staff time, allowing them to focus on delivering better patient care rather than chasing payments.

8 Comprehensive Strategies for Optimizing AR Recovery

To help small practices recover AR quickly and effectively, the following in-depth strategies are crucial and must be followed:

- Implement Clear Billing and Communication Practices

From the very start, practices must ensure patients are fully aware of their payment responsibilities. Here’s how clear communication can make all the difference:

Transparent Billing Policies

Clearly outline payment terms, expected due dates, and insurance coverage details. Provide patients with detailed bills to avoid confusion.

Pre-treatment Estimates

Offering cost estimates before treatment can help set patient expectations, reducing the likelihood of payment delays.

Early Reminders

A few days before a payment is due, send out automated reminders via email or text to gently nudge patients toward paying on time.

- Automate Billing and Payment Processes

Automation is a game-changer in AR recovery, helping practices streamline workflows and reduce manual tasks. Implementing billing software brings many benefits:

Billing Software

Invest in advanced billing systems that generate invoices, send reminders, and track overdue payments automatically. This minimizes human error and speeds up collections.

Online Payment Portals

Offer patients the convenience of paying bills through secure online portals. When payments are easier to make, patients are more likely to settle their accounts promptly.

Recurring Payment Options

Set up automated payment plans for patients with ongoing treatments. This ensures regular payments without requiring patients to manually submit payments each time.

- Enhance Claim Management for Faster Reimbursement

Denied insurance claims are a major cause of delayed AR. Here’s how small practices can improve their claim management:

Designated Claims Team

Assign a dedicated team or staff member to manage claims and handle insurance follow-ups. This ensures that denials are addressed promptly.

Follow-Up on Denied Claims

Regularly review denied claims and resubmit them as necessary. The quicker denials are handled, the sooner payments can be collected.

Documentation and Coding Accuracy

Ensure that all documentation and coding is accurate before submission to minimize the chances of claim denials.

- Focus on High-Value, Overdue Accounts

Not all accounts are created equal. Prioritize efforts on high-value accounts that have been overdue for extended periods:

Aging AR Reports

Generate AR aging reports to track accounts by their age (e.g., 30 days, 60 days, 90 days). Focus on the oldest accounts first, as they are the most at risk of becoming bad debts.

Collections Agency

For accounts that remain unpaid despite repeated follow-ups, consider engaging a professional collections agency. While this should be a last resort, it can help recover older debts.

- Offer Flexible Payment Plans and Incentives

Patients appreciate flexibility, especially when it comes to paying medical bills. Offering payment plans and incentives can boost collections:

Payment Plans

For patients who cannot pay their bills in full, provide structured payment plans that allow them to pay in installments. This makes it easier for them to settle their debts over time.

Early Payment Discounts

Incentivize timely payments by offering small discounts for early settlements. This can encourage patients to pay sooner rather than later.

Loyalty Programs

Implement loyalty programs where patients who consistently pay on time can earn rewards, further promoting prompt payments.

- Leverage Technology for Secure and Transparent Transactions

Security and transparency are critical in modern payment systems. Utilizing Electronic Health Record (EHR) systems integrated with billing software can enhance transparency:

Patient Portals

EHR systems allow patients to view their entire payment history, helping them understand their financial obligations better.

Real-Time Notifications

Keep track of overdue accounts with real-time notifications, so your staff can take immediate action when payments are delayed.

Secure Payment Systems

Use encrypted platforms to protect patient data and reduce the risk of fraud during transactions.

- Provide Multiple Payment Options for Patient Convenience

Different patients have different payment preferences. Offering multiple options makes it easier for them to pay:

Credit Cards and Online Payments

Ensure patients can pay using credit cards, bank transfers, or online payment systems. Integrating mobile-friendly platforms is key to accommodating modern patient preferences.

Physical Payments

While digital payments are on the rise, some patients may still prefer traditional payment methods, such as checks or cash. Be sure to accommodate all preferences to avoid limiting your revenue.

- Outsource Your Billing Operations for Improved Efficiency

For small practices, managing AR in-house can be time-consuming and resource-draining. Outsourcing billing operations can bring several advantages:

Expert Handling of Billing and Claims

By outsourcing your billing, you gain access to a team of professionals who specialize in healthcare billing. They can handle complex claim denials, insurance follow-ups, and patient invoicing, leading to faster recoveries.

Cost Savings

Outsourcing reduces the need for full-time, in-house billing staff, cutting down on labor costs, software investments, and overhead expenses.

Focus on Patient Care

With the administrative burden of billing taken care of, your team can focus more on delivering high-quality patient care rather than managing paperwork and following up on payments.

Scalability

As your practice grows, outsourced billing services can easily scale up to handle larger volumes of claims and invoices, ensuring you never miss a beat.

Conclusion: Proactive AR Management with MediBill Health Partners

Managing AR effectively is more than a necessity it’s the foundation of a financially healthy practice. By implementing these eight in-depth strategies, small healthcare practices can significantly improve their AR recovery and ensure a steady cash flow.

At MediBill Health Partners, we specialize in helping practices enhance their billing processes, reduce outstanding payments, and maintain financial stability. Our team is ready to assist you in creating a customized AR recovery plan that aligns with your practice’s specific needs. Reach out to us today for a complimentary AR analysis, and let us guide you toward more efficient recovery processes.